Букмекерская контора Winline начала свою деятельность в 2009 году. Сайт для приема ставок стал работать с 2016 года. Деятельность букмекера полностью законна, что подтверждает лицензия РФ. Связь конторы с первым ЦУПИС защищает игроков БК от проблем с выплатами. Цель компании – обеспечить качественное обслуживание рынке БК.

Компанию Winline часто выделяют рейтинговые агентства. Так, контора получила оценку 5 из 5 в «Рейтинге букмекеров» и высший балл на Legalbet. Специализированные форумы отмечают отличную работу службы поддержки. В 2015 Винлайн был признан лучшим букмекерским продуктом на выставке-форуме Russian Gaming Week.

БК Винлайн выступает партнером футбольного клуба «Спартак», телеканала «Матч ТВ», сайта спорт.ру, журнала «Спорт-Экспресс». Деятельность БК Винлайн регулируется бессрочной лицензией ФНС России №7, полученной в 2009 года и переоформленной в 2016 году.

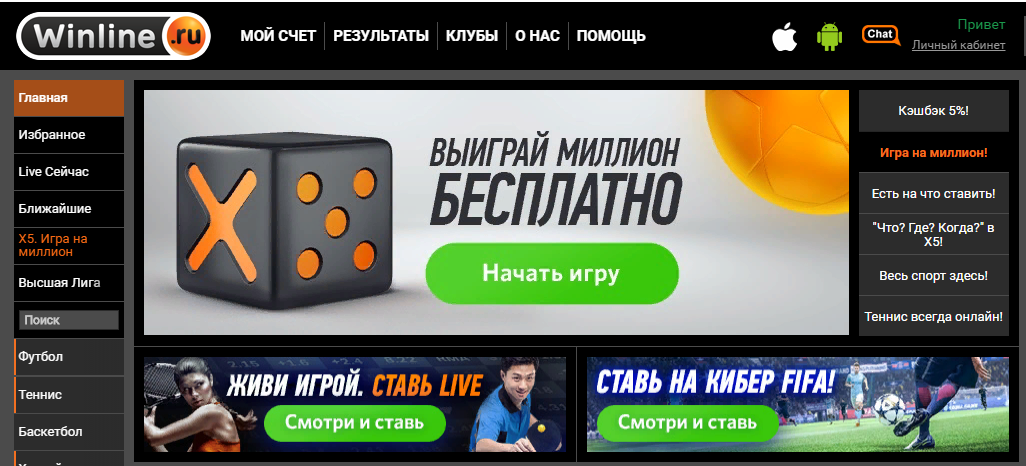

Дизайн сайта

Интерфейс не отличается дизайнерской оригинальностью, но выделяется удобным функционалом. Цвета (черный, оранжевый, зеленый) не отвлекают от основных действий и событий. Нет всплывающей рекламы от партнеров. Практически все необходимые манипуляции можно сделать интуитивно. На сайте много подробных подсказок, есть чат с помощником.

БК Winline: вход в личный кабинет

Доступ в личный кабинет Винлайн будет осуществлен после процедуры регистрации. Зарегистрироваться на сайте могут только игроки в возрасте от 18 лет. Для подтверждения аккаунта необходимо загрузить фото паспорта. Чтобы делать ставки нужно пройти полную идентификацию. Это сделать можно в стационарной конторе букмекера, через видеосвязь на сайте или воспользоваться учетной записью в ЦУПИС.

Кнопка «Личный кабинет» находится в верхнем правом углу сайта. Здесь отображаются: история ваших ставок, личные данные, денежные операции. В функционале предусмотрена возможность связи со службой поддержки.

Также в личный кабинет можно попасть через вкладку «Мой счет» (верхний левый угол), всплывающим окном выйдет тот же «личный кабинет»

Войти в личный кабинет Winline

Выбор ставки

Компания Винлайн каждый день размещает на сайте до тысячи событий из мира спорта. Некоторые матчи можно посмотреть через видеотрансляции онлайн. В число главных событий входит 24 турнира. Самыми популярными видами спорта считаются: футбол, баскетбол, хоккей, теннис, волейбол, баскетбол. Встречаются и менее популярные игры: кибер FIFA, Дартс, сквош, киберспорт.

Бессменным лидером остается футбол. Один футбольный турнир может достигать сотни возможностей для ставок. Чем популярнее спорт, тем лучше роспись.

Огромное количество турниров позволяет выбрать хороший коэффициент для своей ставки. Если коэффициент падает, то он выделяется красным цветом, если растет – зеленым.

Налог на выигрыш

С выигрышей на официальном сайте букмекерской конторы Винлайн удерживаются налоги. Это правило обусловлено легальной деятельностью БК в рамках Российского законодательства. Налог составляет 13% от выигрыша.

Однако, каждый игрок должен знать некоторые тонкости. Игрок не платит налог, если его годовой выигрыш составляет менее 4000 рублей. Если вы заработали менее 15000 рублей, то вы должны самостоятельно оплатить процент в налоговой службе с предоставлением декларации о доходах.

Из выигрыша более 15 тысяч рублей контора сама вычитает налог, поэтому декларацию подавать не надо. Правила налога едины для всех БК, которые работают в РФ официально.

Любые вопросы о выплатах по выигрышу, можно задать на сайте первого ЦУПИС (центр учета переводов интерактивных ставок).

Букмекерская компания Winline: бонусы на официальном сайте

Информация об акциях находится в графе «О нас» (центр страницы), где всплывающим окном появляется раздел «Предложения». Акции могут носить долговременный характер. В число основных предложений сейчас входят: бесплатная ставка (за установку мобильного приложения), кэшбэк (5% от депозита), удвоение первой ставки (в течение 24 часов после регистрации) и многие другие интересные предложения.

Каждый игрок может воспользоваться выкупом ставок, что позволяет выводить деньги до завершения матча. Такой выигрыш, как правило, меньше суммы заключенного пари.

Ставки с мобильного телефона

Вы можете делать ставки на сайте с мобильного устройства, а также с помощью приложения для смартфона. Программа адаптирована для Андроид и для iOS. Приложения сохраняют весь функционал сайта и позволяют:

- делать ставки на любое спортивное событие;

- ставить на спорт в лайв-режиме;

- просматривать все видеотрансляции;

- участвовать в акциях, получать бонусы;

- выводить выигрыш, класть деньги на депозит;

- обращаться в службу поддержки при необходимости.

- Скачивание приложений доступно на основном ресурсе в верхнем правом углу.

Платежные системы для Винлайн

Для вывода выигрыша и пополнения лицевого счета существует много удобных способов. Вы можете выбрать удобную для себя платежную систему:

- практически любой электронный кошелёк (Яндекс, Вебмани, Киви-кошелёк и т.д);

- банковские карты;

- мобильные системы платежей любого оператора;

- интернет-банки;

- ЦУПИС-кошелек;

- платеж наличными в любом ближайшем салоне Евросеть/Связной.

Максимальная сумма вывода для банковских карт и ЦУПИС кошелька – 550 тысяч рублей. Сумма депозита должна быть не менее 500 рублей. Деньги на личный счет приходят быстро. Вывести выигрыш также оперативно не выйдет, так как берется во внимание сумма и работа самой платежной системы. Если вы захотите вывести деньги на счет мобильного телефона, то ваш сотовый оператор возьмет комиссию (размер у каждого свой).

Сравнительный анализ с зарубежной версией

Зарубежный сайт bkwinlinebet com не имеет отношения к российской компании Винлайн. Сайты контор похожи внешне, но отличаются правилами оказания услуг в законодательстве РФ.

Основное отличие в том, что winline.ru – это официальный букмекер, работающий на легальных условиях, а winline.com не имеет права оказывать услуги в России. Игроки легальной конторы платят налоги с выигрыша, а во втором случае нет возможности проконтролировать налог.

Споры между игроком и букмекером в ситуации с зарубежной компанией решать некому. Откуда ждать поддержки, если вы сами попытались нарушить закон, связавшись с нелегальным букмекером? Споры будут трактоваться в пользу БК, даже если компания неправа. Букмекерская компания Winline предоставляет официальные услуги, поэтому справедливости добиться можно гораздо проще с помощью российского законодательства.

Есть отличия и в способах регистрации игрока. В российской компании требуется полная идентификация при личном визите в пункт букмекера в некоторых городах (Москва, Сочи, Пермь и т.д.) или через видео-звонок (skype, whatsapp, viber, facetime) по согласованию времени с сотрудником компании. Зарубежный ресурс позволяет делать ставки без подтверждения личности. Однако, для вывода выигрыша, вам всё-таки придется отправить дубликат паспорта с пропиской, а также данные платежной системы.

Официальный сайт зарубежной версии в России заблокирован, так как он не имеет права оказывать услуги на нашей территории. Пользователи вынуждены искать «Зеркало» сайта или менять настройки своего ПК.

Плюсы и минусы официального сайта букмекерской конторы Винлайн

Сайт Винлайн понятный, удобный и интересный. К числу его плюсов можно отнести:

- большой выбор спортивных соревнований, широкая роспись;

- гарантированное получение выигрыша;

- удобные и быстрые мобильные приложения с разрешением для Андроид и для Айфон;

- грамотная техническая поддержка, работающая круглосуточно;

- широкий выбор способов пополнения счета и вывода средств;

- функциональный интерфейс;

- интересные акции и специальные предложения.

Ряд недостатков также заслуживает внимания:

- идентификация личности, что усложняет регистрацию;

- делать ставки могут только граждане РФ;

- иногда «тормозит» лайв;

- нет казино;

- налог на выигрыш – 13%.

Учитывая то, что букмекерская компания работает легально, можно не бояться беспредела и незаконной потери денег. Взыскание налогов – необходимая мера, потому что абсолютно все БК по законам РФ обязаны работать таким образом. Компания гарантирует, что любые средства, появившиеся на личном счете, а также любые выигрыши, вне зависимости от размера, будут доступны к выводу в течение 24 часов. Слоган букмекерской конторы: «Winline заплатит. Без вариантов».